Rest@rts supports non-bankable young people in the Mediterranean by promoting an alternative financing mechanism: Crowdfunding

The pre-pandemic business financing environment was generally favorable, as entrepreneurs benefited from low interest rates, and an increased supply of financial instruments. However, the COVID-19 crisis has hit the revenue and profitability of small and medium-sized enterprises (SMEs), creating severe liquidity shortages in businesses and threatening the survival for many of them. According to the report Financing SMEs and Entrepreneurs: An OECD Scoreboard, lending volumes in many countries around the world have increased to meet the growing demand from small businesses, in an effort to make up for the lack of liquidity by taking on more debt. Public policies implemented to mitigate restrictive liquidity have played a key role in this regard.

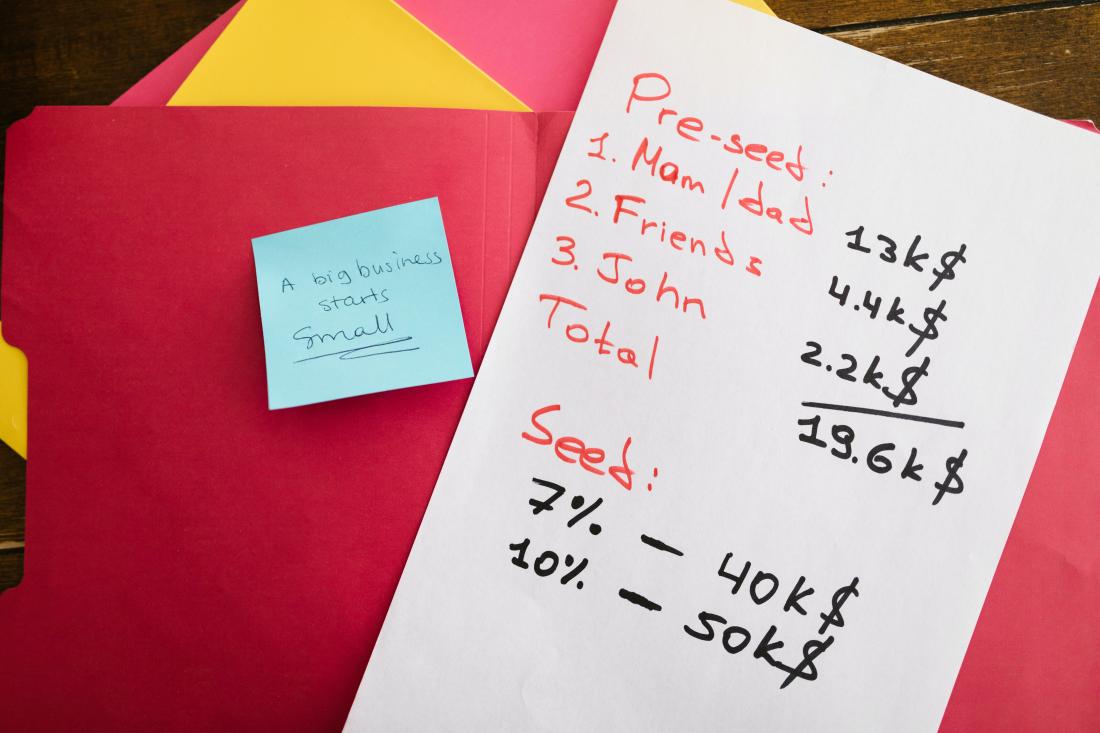

In the case of Cyprus, financial support for start-ups and growing businesses continues to be one of the main weaknesses of the island's ecosystem. As the GEM National Report 2019/2020 survey shows, such companies may have relatively adequate access to financial support from informal investors such as family members, friends or colleagues, as well as government grants. However, access to privately supported funding, although improved, remains limited and lower than the rest of Europe average.

Crowdfunding might be the answer for meeting the financial needs of a slightly larger segment of the SME population, allowing them to raise funds from private investors.

But what is Crowdfunding? It is an alternative method of financing for SMEs and start-ups, where funds are raised to finance projects, ideas and businesses, enabling fundraisers to raise money from a large number of people through an online platform. The main "players" in Crowdfunding are the owner of an idea / project / business, the audience / investors, and the platform. The Owner organizes a fundraising campaign through the online Platform and the Public invests in return. Depending on the type of Crowdfunding adopted, the exchange-benefit of the Public in this process also varies. The main types are those of lending, reward, donation, issuance of shares and securities.

The Cyprus Chamber of Commerce and Industry (CCCI) participates in the Rest@rts project with the aim of breaking down the financing barrier especially for young entrepreneurs that must fight much more than the average to get proper funding for their business, supporting in this way the so-called “non-bankable” young people. Targeting both entrepreneurs and microfinance providers, a marketplace platform will be developed through the Rest@rts project to gather the supply and demand in a friendly and easily accessible business environment. In this platform, crowdfunding will be playing a key role, as the ReSt@rts partners understand that the use of alternative financing is essential whenever the traditional ways of funding fail. Thanks to ReSt@rts, many Mediterranean young would-be entrepreneurs will get a new chance to fund their business ideas. Eventually, concerned entrepreneurs will have access to a wide Mediterranean cross-border networks of investors.